‘Stay away from the Bookstore’

Most parents will agree that teaching kids to save money is an essential life skill. Beyond just ‘staying away from the school bookstore’ (think varieties of colourful ,and some flavourful, erasers, a variety of sharpeners with glitter and, yes, those ‘Frozen’ merchandise.), the importance of teaching our kids to save for a rainy day may sometimes be overshadowed by seemingly more pressing matters like academic pursuits, CCA, DSA and yes, prepping for PSLE.

The Cashless Conundrum:

What complicates matters as a teen, they are bombarded with temptations to spend everywhere they go. Not only do their needs and wants get more costly, their spending urge is tangibly felt. This makes delayed gratification harder.

So, do we shield our kids from the cashless world or do we embrace it? If we shield them now, how will they learn to navigate the cashless world? If we embrace it, how can we teach our kids to navigate the cashless world sensibly?

A Teenager in ‘da House

For us, we took the opportunity to teach our newly minted 13 year old to save and to spend the cashless way. After all, teens are learning to make their own big and small decisions everyday.

How do we help our teen navigate the cashless world whilst developing a good saving habit?

Empowering and Educating

Like many good habits, we need to use strategies to educate and empower our children, with enough room and latitude for them to learn and fail.

Here are some tips from our experience:

- Discuss household expenses with them: This sets the context and helps them to appreciate the need to spend wisely. We share with her that as a family unit, we all need to be accountable for our spending to keep the household expenditure down.

- Record your savings: Rather than record what they spend on, we encourage our daughter to record what she saves daily. This helps her develop a ‘save more spend less’ perspective.

- Set a weekly limit: Rather than setting a daily limit, we set a weekly limit for our daughter. That way, our kids learn to manage their own finances within the week, toggling as the days go by, without Mom and Dad hovering over them.

- Save for a rainy day: We should not shield our kids from the trials and struggles of life. It’s real and therefore we should all be mentally prepared for it. This includes saving for times when we need to spend extra for it, be it medical bills, repair of mobile phone, replacement of lost air pods charger (all of which has happened before) etc.

- Save to bless: Helping others is key to nurture a sense of compassion and empathy in our kids. Channeling part of their financial resources to help others is a good life lesson so we encourage our daughter to use some of her savings to bless those around her in need.

- Save it weekly: At the end of the week, we go through the amount saved and help transfer an agreed amount into her bank account. This way, she could tangibly see her money ‘growing’.

- Use a debit card: In order for our kids to get attuned to the world of cashless spending, we use CANVAS, a prepaid Visa card that are suitable for teens! It works just like a ‘digital pocket money’ of sorts.

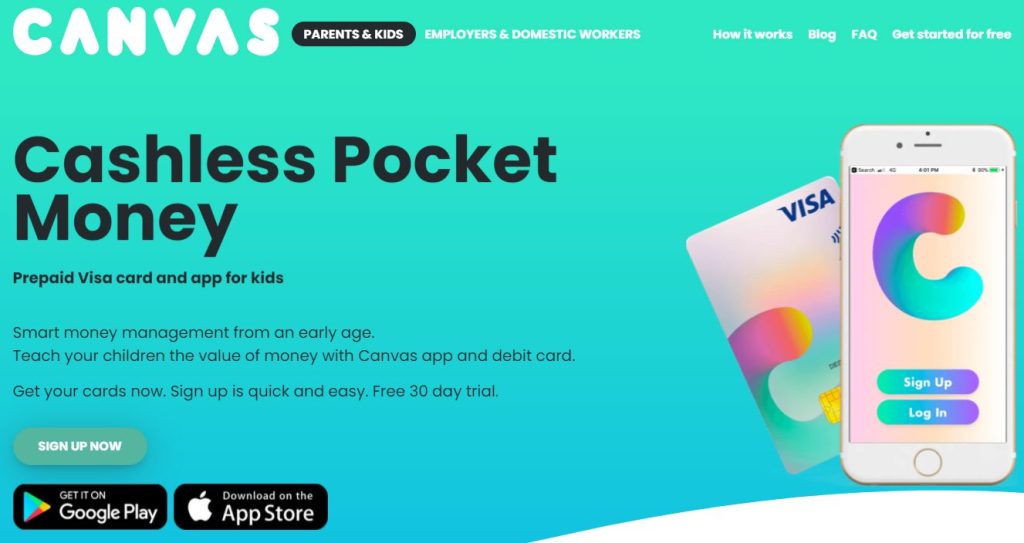

CANVAS – The Prepaid VISA Debit Card

Set up by a group of parents themselves, CANVAS is a prepaid Visa debit stored-value card that allows parents to transfer monies to the card for teens to carry around and use.

With the CANVAS card, we set a routine where our teen shows us how much she has saved weekly. We then safekeep the money for her while transferring an agreed amount to the CANVAS card where she can use to buy items she needs (much like a ‘petty cash’ system).

Recently, during the September school holidays, Daddy accompanied Dana on a medical visit and they decided to lunch at the nearby mall. With the portion of savings deposited in the CANVAS card, Dana bought herself the ‘Llao Llao’ dessert, shopped for a friend’s birthday gift at ‘Typo’, bought a new pair of socks at ‘Uniqlo’ and even topped-up her EZ-Link card for MRT rides. She then used the balance to buy her Daddy a Koi! Bubble Tea! All these paid with a tap of the CANVAS card, without lugging any cash around.

Daddy was impressed to see how the CANVAS card allows Dana to monitor her own expenditure, empowering her to prioritize and spend wisely, within her limits. Dana was also stoked to pay for her purchases with the sleek CANVAS card as it makes her feel like a young adult.

Too Good To Be True?

Here are reasons why we like the CANVAS prepaid Visa debit card:

- It teaches smart money management from a young age – enables our children to monitor and manage their own pocket money, allowances and expenses with the help of technology.

- The user-friendly CANVAS app allows us to transfer and top up monies to the card(s) seamlessly and instantly.

- Spending is deducted instantly, allowing the kids to get a real sense of expenses paid and actual balance left.

- There is no risk of over-spending since it’s a prepaid debit card.

- We can deactivate the card instantly in the event it is misplaced or lost.

- We have instant access to the help chat via WhatsApp.

- The card can be used over most, if not all, Visa PayWave terminals at retail check-out counters.

- It reduces the need to carry a heavy and bulky wallet around where money cannot be retrieved once the wallet is lost.

CANVAS card is the first bona-fide prepaid Visa debit card that can be owned by teens, kids or whoever the parents entrust the card to (this includes Foreign Domestic Workers). Amount saved, transferred and spent can all be conveniently tracked and managed via the CANVAS app (available in Android and IOS). Parents have full control yet can empower our kids to save and spend wisely in this cashless world they are growing up in.

Sign up Offer:

To enjoy a 30-day Free Trial plus free S$10 value in the card to start-off, sign up using this link:

https://info.yourcanvas.co/dotingdad-sign-up

Find out more about CANVAS from these sites:

Leave a Reply